BadEconomics: Putting $400M of Bitcoin on your company balance sheet

This is an excuse to have a blog post on the economics of Bitcoin to refer people to.

Intended Audience: Laypersons interested or confused about Bitcoin.

Reading Time: 15min

Disclaimer: I moved to being short BTC financially several months after publishing this post (this post if from August 2020, I became short BTC in late December).

A couple of months ago, MicroStrategy (MSTR) had a spare $400M of cash which it decided to shift to Bitcoin (BTC).

When a company has a pile of spare money it doesn’t know what to do with, it’ll normally do buybacks or start paying dividends. That gives the money back to the shareholders, and from an economic perspective the money can get better invested in other more promising companies[footnote] In fact, MSTR tried to do buybacks for $250M on the same day it announced shifting other reserves to BTC. Which makes it hard to attribute the subsequent 9% jump in share value.[/footnote]. If you have a huge pile of of cash, you probably should be doing other things than leave it in a bank account to gather dust[footnote]However, mixing a big part of your company’s balance sheet with a pile of BTC is strange, because it correlates the value of your software company’s stock with movements in BTC instead of its business performance[/footnote].

However, this statement from MicroStrategy CEO Michael Saylor exists to make it clear he’s buying into BTC for all the wrong reasons[footnote]In fact MSTR has an entire page on their BTC position[/footnote]:

“This is not a speculation, nor is it a hedge. This was a deliberate corporate strategy to adopt a bitcoin standard.”

Let’s unpack it and jump into the economics Bitcoin:

Is Bitcoin money?

No.

Or rather BTC doesn’t act as money and there’s no serious future path for BTC to become a form of money. Let’s go back to basics. There are 3 main economic problems money solves:

1. Medium of Exchange. Before money we had to barter, which led to the double coincidence of wants problem[footnote]Some anthropologists might get angry at this point saying that before currency, trade was done through informal credit systems. This is irrelevant, because trade outside the tribe didnt’t work on credit and required barter. Moreover, with agriculture and civilizations, we excedeed the complexity at which the informal system worked and required a currency to be a ledger of economic value.[/footnote]. When everyone accepts the same money you can buy something from someone even if they don’t like the stuff you own.

As a medium of exchange, BTC is not good. There are significant transaction fees and transaction waiting times built-in to BTC and these worsen the more popular BTC get.

You can test BTC’s usefulness as a medium of exchange for yourself right now: try to order a pizza or to buy a random item with BTC. How many additional hurdles do you have to go through? How many fewer options do you have than if you used a regular currency? How much overhead (time, fees) is there?

2. Unit of Account. A unit of account is what you compare the value of objects against. We denominate BTC in terms of how many USD they’re worth, so BTC is not a unit of account presently. We can say it’s because of lack of adoption, but really it’s also because the market value of BTC is so volatile.

If I buy a $1000 table today or in 2017, it’s roughly a $1000 table. We can’t say that a 0.4BTC table was a 0.4BTC table in 2017. We’ll expand on this in the next point:

3. Store of Value. When you create economic value, you don’t want to be forced to use up the value you created right away.

For instance, if I fix your washing machine and you pay me in avocados, I’d be annoyed. I’d have to consume my payment before it becomes brown, squishy and disgusting[footnote]About 7 femtoseconds on my kitchen counter[/footnote]. Avocado fruit is not good money because avocados loses value very fast.

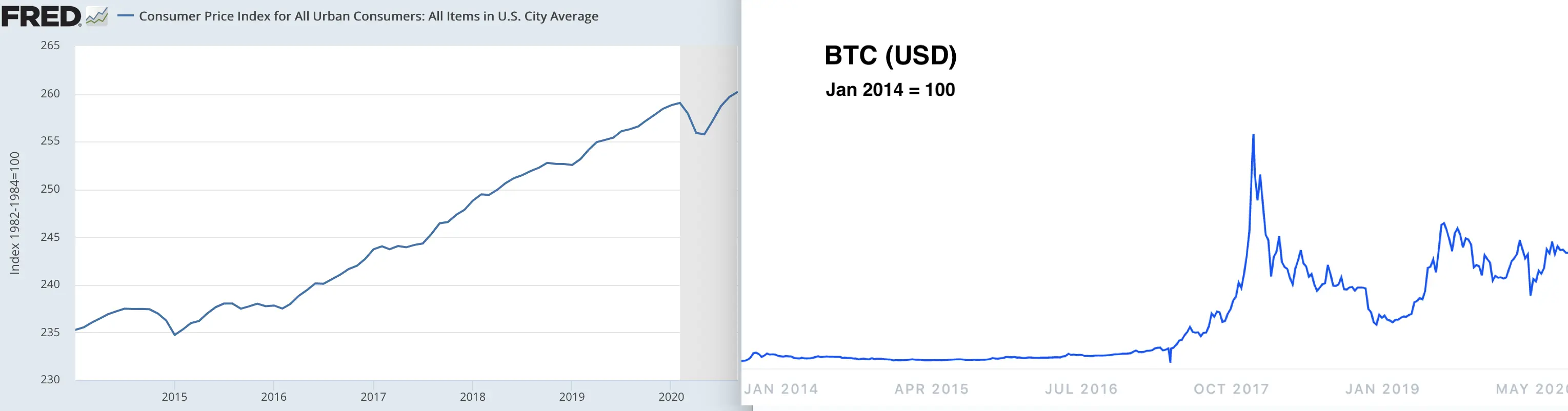

On the other hand, well-run currencies like the USD, GBP, CAD, EUR, etc. all lose their value at a low and most importantly fairly predictible rate[footnote]We’ll talk later about why it’s better for a currency to have inflation than deflation or hovering at the same price forever[/footnote]. Let’s look at the chart of the USD against BTC:

While the dollar loses value at a predictible rate, BTC is all over the place, which is bad.

One important use money is to write loan contracts. Loans are great. They let people spend now against their future potential earnings, so they can buy houses or start businesses without first saving up for a decade. Loans are good for the economy.

If you want to sign something that says “I owe you this much for that much time” then you need to be able to roughly predict the value of the debt in at the point in time where it’s due.

Otherwise you’ll have a hard time pricing the risk of the loan effectively. This means that you need to charge higher interests. The risk of making a loan in BTC needs to be priced into the interest of a BTC-denominated loan, which means much higher interest rates. High interests on loans are bad, because buying houses and starting businesses are good things.

BTC has a fixed supply, so these problems are built in

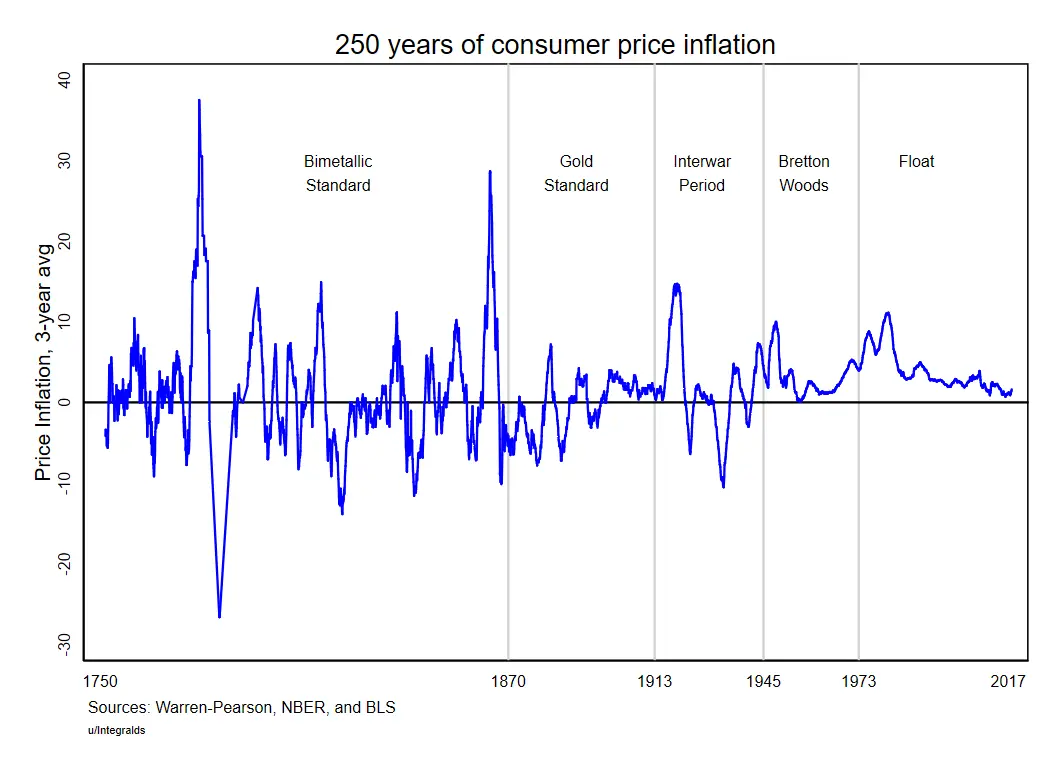

Some people think that going back to a standard where our money was denominated by a stock of gold (the Gold Standard) would solve economic problems. This is nonsense.

Having control over supply of your currency is a good thing, as long as it’s well run.

Remember that what is desirable is low variance in the value, not the value itself. When there are wild fluctuations in value, it’s hard for money to do its job well.

Since the 1970s, the USD has been a fiat money with no intrinsic value. This means we control the supply of money.

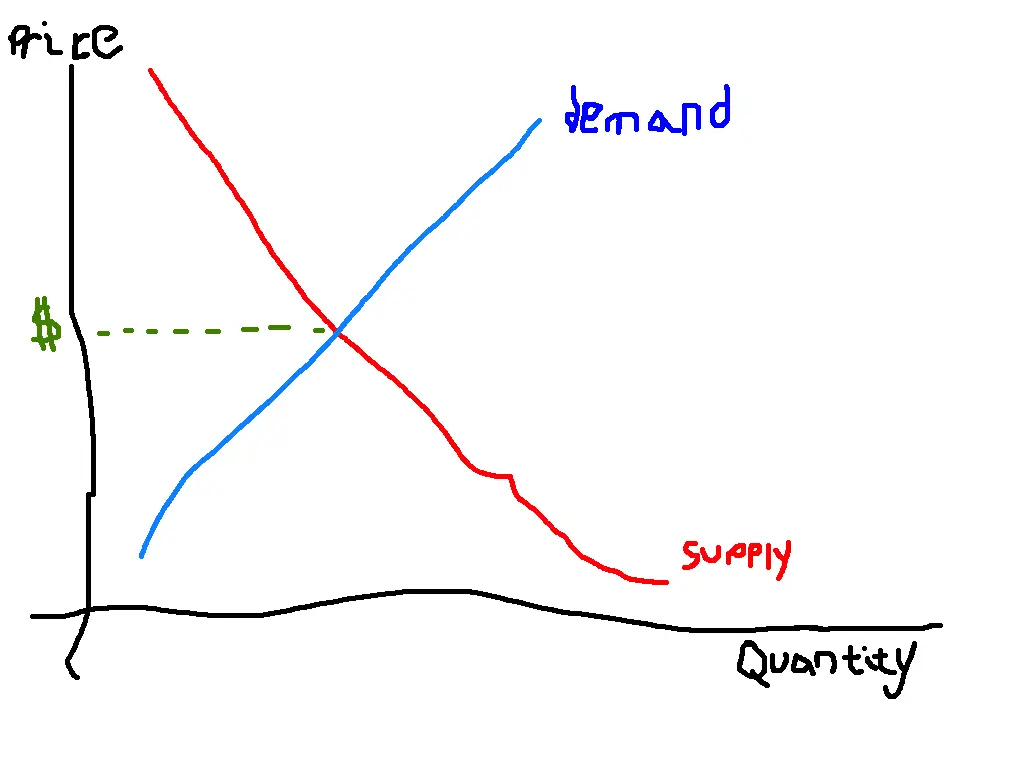

Let’s look at a classic poorly drawn econ101 graph[footnote]Yes, supply and demand are reversed. It’s part of the joke[/footnote]:

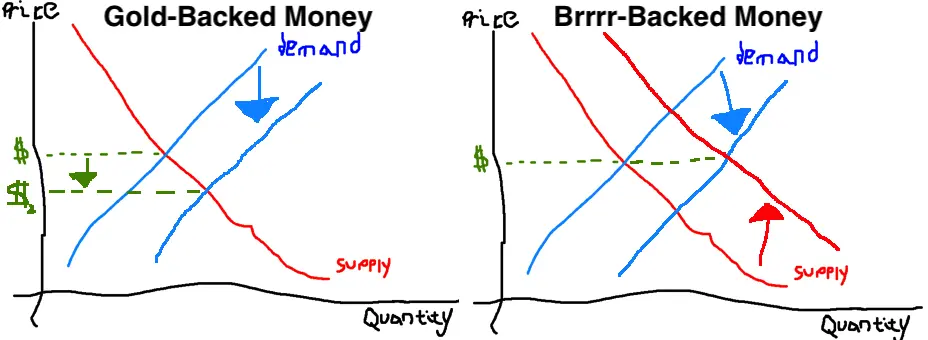

The market price for USD is where supply meets demand. The problem with a currency based on an item whose supply is fixed is that the price will necessarily fluctuate in response to changes in demand.

Imagine, if you will, that a pandemic strikes and that the demand for currency takes a sharp drop. The US imports less, people don’t buy anything anymore, etc. If you can’t print money, you get deflation, which is worsens everything [footnote]Deflation makes you less likely to spend money, because spending the same money in the future will let you buy more things. This creates the opposite of economic stimulus, which is what you’d want in a depression.[/footnote]. On the other hand, if you can make the money printers go brrrr you can stabilize the price:

Having your currency be based on a fixed supply isn’t just bad because in/deflation is hard to control [footnote]Partly why the great depression under the gold standard was so much worse than the 2008 recession[/footnote].

It’s also a national security risk…

The story of the guy who crashed gold prices in North Africa

In the 1200s, Mansa Munsa, the emperor of the Mali, was rich and a devout Muslim and wanted everyone to know it. So he embarked on a pilgrimage to make it rain all the way to Mecca.

He in fact made it rain so hard he increased the overall supply of gold and unintentionally crashed gold prices in Cairo by 20%, wreaking an economic havoc in North Africa that lasted a decade.

This story is fun, the larger point that having your inflation be at the mercy of foreign nations is an undesirable attribute in any currency. The US likes to call some countries currency manipulators, but this problem would be serious under a gold standard.

Currencies are based on trust

Since the USD is based on nothing except the US government’s word[footnote]And I guess its army to back up that word[/footnote], how can we trust USD not to be mismanaged?

The answer is that you can probably trust the fed until political stooges get put in place. Currently, the US’s central bank managing the USD, the Federal Reserve (the Fed for friends & family), has administrative authority. The fed can say “no” to dumb requests from the president.

People who have no idea what the fed does like to chant “audit the fed”, but the fed is already one of the best audited US federal entities. The transcripts of all their meetings are out in the open. As is their balance sheet, what they plan to do and why. If the US should audit anything it’s the Department of Defense which operates without any accounting at all.

It’s easy to see when a central bank will go rogue: it’s when political yes-men are elected to the board.

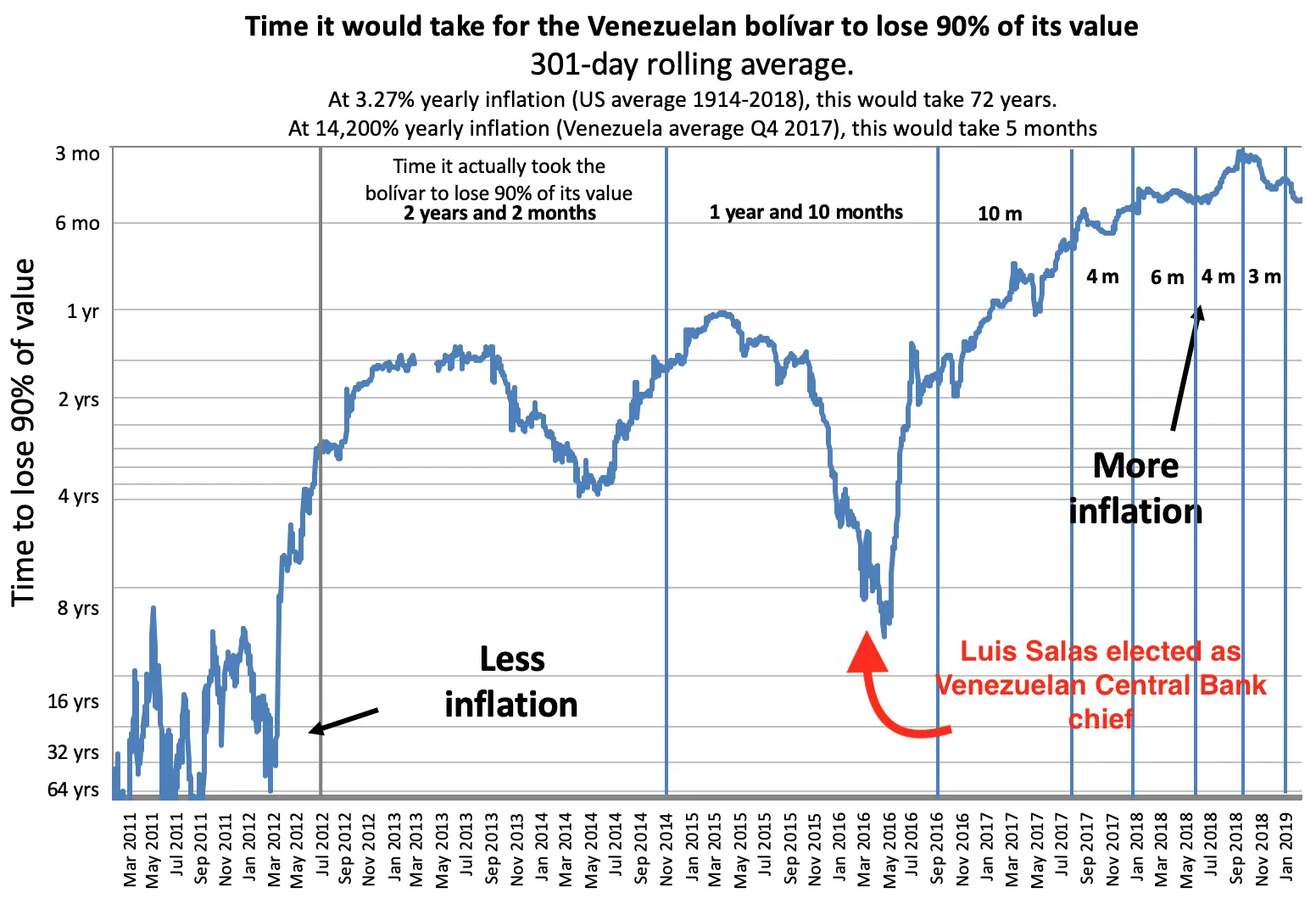

For example, before printing themselves into hyperinflation, the Venezuelan president appointed a sociologist who publicly stated “Inflation does not exist in real life” and instead is a made up capitalist lie. Note what happened mere months after his gaining control over the Venezuelan currency:

This is a key policy. One paper I really like, Sargent (1984) “The end of 4 big inflations” states:

The essential measures that ended hyperinflation in each of Germany, Austria, Hungary, and Poland were, first, the creation of an independent central bank that was legally committed to refuse the government’s demand or additional unsecured credit and, second, a simultaneous alteration in the fiscal policy regime.

In english: hyperinflation stops when the central bank can say “no” to the government."

The US Fed, like other well good central banks, is run by a bunch of nerds[footnote]Luckily for Americans, the fed was too boring and arcane for Trump to meddle with it, unlike other federal agencies[/footnote]. When it prints money, even as aggressively as it has it does so for good reasons. You can see why they started printing on March 15th as the COVID lockdowns started:

The Federal Reserve is prepared to use its full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals.

In english: We’re going to keep printing and lowering rates until jobs are back and inflation is under control. If we print until the sun is blotted out, we’ll print in the shade.

BTC is not gold

Gold is a good asset for doomsday-preppers. If society crashes, gold will still have value.

How do we know that?

Gold has held value throughout multiple historic catastrophes over thousands of years. It had value before and after the Bronze Age Collapse, the Fall of the Western Roman Empire and Gengis Khan being Gengis Khan.

Even if you erased humanity and started over, the new humans would still find gold to be economically valuable. When Europeans d̶i̶s̶c̶o̶v̶e̶r̶e̶d̶ c̶o̶n̶q̶u̶e̶r̶e̶d̶ g̶e̶n̶o̶c̶i̶d̶e̶d̶ went to America, they found gold to be an important item over there too. This is about equivalent to finding humans on Alpha-Centauri and learning that they think gold is a good store of value as well.

Some people are puzzled at this: we don’t even use gold for much! But it has great properties:

First, gold is hard to fake and impossible to manufacture. This makes it good to ascertain payment.

Second, gold doesnt react to oxygen, so it doesn’t rust or tarnish. So it keeps value over time unlike most other materials.

Last, gold is pretty. This might sound frivolous, and you may not like it, but jewelry has actual value to humans.

It’s no coincidence if you look at a list of the wealthiest families, a large number of them trade in luxury goods.

To paraphrase Veblen humans have a profound desire to signal social status, for the same reason peacocks have unwieldy tails. Gold is a great way to achieve that.

On the other hand, BTC lacks all these attributes. Its value is largely based on common perception of value. There are a few fundamental drivers of demand:

-

Means of Exchange: if people seriously start using BTC to buy pizzas, then this creates a real demand for the currency to accomplish the short-term exchanges. As we saw previously, I’m not personally sold on this one and it’s currently a negligible fraction of overall demand.

-

Criminal uses: Probably the largest inbuilt advantage of BTC is that it’s anonymous, and so a great way to launder money. Hacker gangs use BTC to demand ransom on cryptolocker type attacks because it’s a shared way for an honest company to pay and for the criminals to receive money without going to jail.

Apart from these, it’s hard to argue that BTC will retain value throughout some sort of economic catastrophe.

BTC is really risky

One last statement from Michael Saylor I take offense to is this:

“We feel pretty confident that Bitcoin is less risky than holding cash, less risky than holding gold,” MicroStrategy CEO said in an interview

“BTC is less risky than holding cash or gold long term” is nonsense. We saw before that BTC is more volatile on face value, and that as long as the Fed isn’t run by spider monkeys stacked in a trench coat, the inflation is likely to be within reasonable bounds.

But on top of this, BTC has Abrupt downside risks that normal currencies don’t [footnote]unless the country collapses into civil war, at which you probably have bigger issues than your investment portfolio[/footnote]. Let’s imagine a few:

-

A critical software vulnerability is found in the BTC codebase, leading to a possible exploitation.

-

Governments decide they had enough of rich people hiding their assets from him and ban BTC.

-

Ponzi mechanics creating a bank run (hi Tether!). Because BTC wallets are uninsured, unlike regular banks, this compounds into a Black Tuesday style crash.

-

Some form of 51% attack succeeds

Blockchain solutions are fundamentally inefficient

Blockchain was a cute idea. I still think the initial white paper was a cool mix of economics and computer science. But Adam Back Satoshi knew more about cryptography than economics. A deflationary currencies is inherently flawed as a means of exchange, because people are incentivized to save. Bitcoin was never going to become a good currency, but it had a great shot at becoming a decentralized pyramid scheme.

Moreover, blockchain solutions make large tradeoffs in design because they assume almost no trust between parties. This leads to intentionally wasteful designs on a massive scale.

The main problem is that all transactions have to be validated by expensive computational operations and double checked by multiple parties. This means waste:

-

BTC was estimated to use as much electricity as Belgium in 2019. It’s hard to trace where the BTC mining comes from, but we can assume it has a huge carbon footprint.

-

A single transactions is necessarily expensive. A single transaction takes as much electricity as 800,000 VISA transactions, or watching 50,000 hours of youtube videos.

-

There is a large necessary tax on the transaction, since those checking the transaction extract a few BTC from it to be incentivized to do the work of checking it.

Many design problems can be mitigated by various improvements over BTC, but it remains that a simple database always works better than a blockchain if you can trust the parties to the transaction.