Starting a Brick & Mortar Business in 2020

It’s 2020, Canada is barely out of COVID, and here I am launching a physical business with my wife [footnote]I’m still also working as a data scientist. That explains my lack of blogging for the last few months[/footnote]. As someone who’s worked behind a computer his whole life, I learned a few things:

The Opportunity

My wife has been a dog trainer for 5 years. She taught at a handful of schools around the Montreal area, and has competed with our australian shepherd Maple in dog agility at the national level for a few years. Here’s Maple zooming around a course:

[caption id=“attachment_1201” align=“alignnone” width=“2560”] Maple, zooming out of a tunnel and onto another obstacle[/caption]

Maple, zooming out of a tunnel and onto another obstacle[/caption]

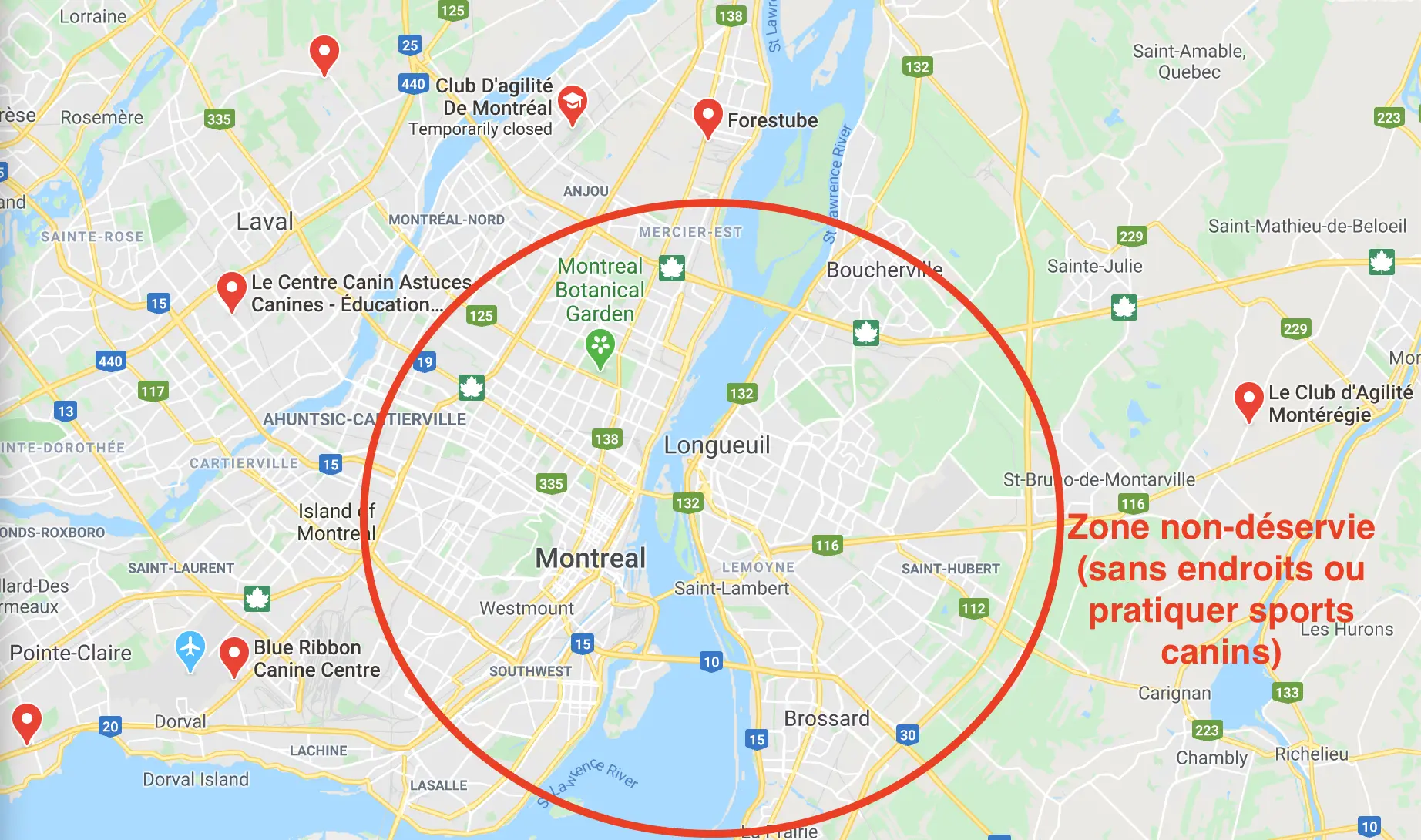

We live in Montreal, close to downtown and practice dog sports regularly. Yet, the closest place to practice was ~45min away:

[caption id=“attachment_1203” align=“alignnone” width=“1844”] Excuse the french annotations[/caption]

Excuse the french annotations[/caption]

So the natural evolution as frustrated consumers, and as people with the ability to fill this gap in the market, would be to open a dog training facility somewhere in the red circle.

Commercial Renting in an Urban Center

We live near a commercial street in a densely populated neighbourhood of Montreal, and COVID absolutely decimated local businesses. I’d estimate 1/7 of small local businesses in our area closed during COVID, freeing up a lot of commercial real estate.

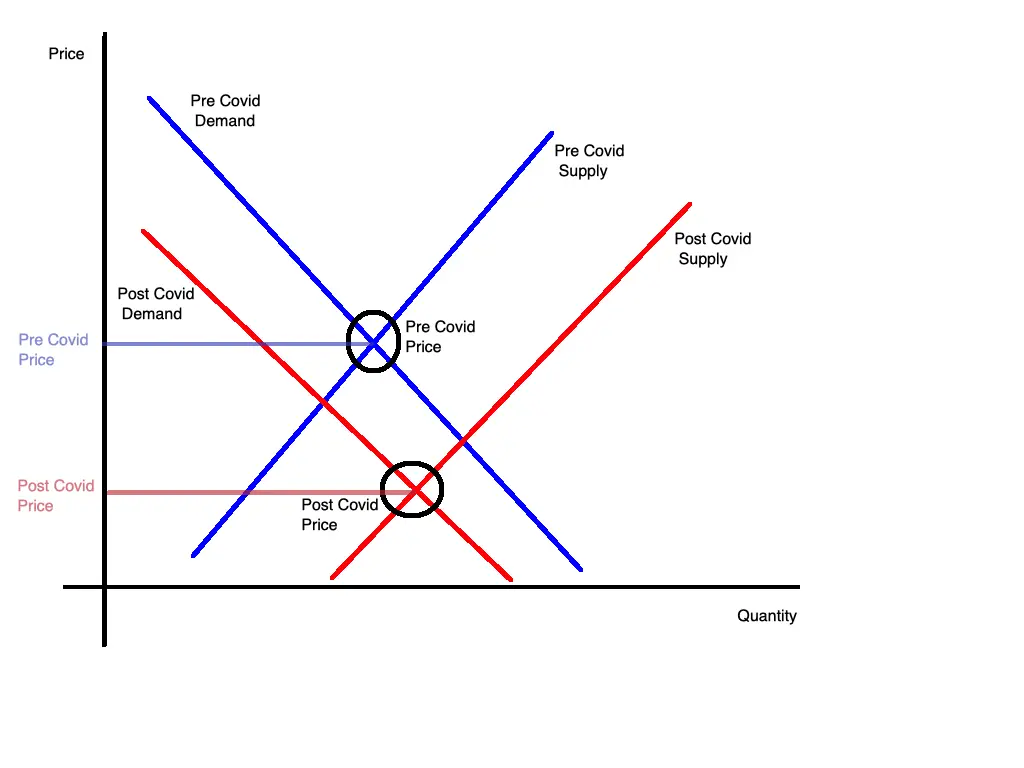

We thought we’d undercut the renting market – we have this positive supply shock and negative demand shock. Who except us would be stupid enough to open a business in COVID?

What we observed instead is that asking commercial rents didn’t decrease all that much. Sure, we could negotiate terms a bit more freely because we were the only ones on the market. But we didn’t get 50% discounts or anything like that.

Real estate markets in urban areas like Montreal are weird beasts and there are all sorts of broken incentives for landlords.

There are a few reasons why landlords aren’t abiding by econ 101:

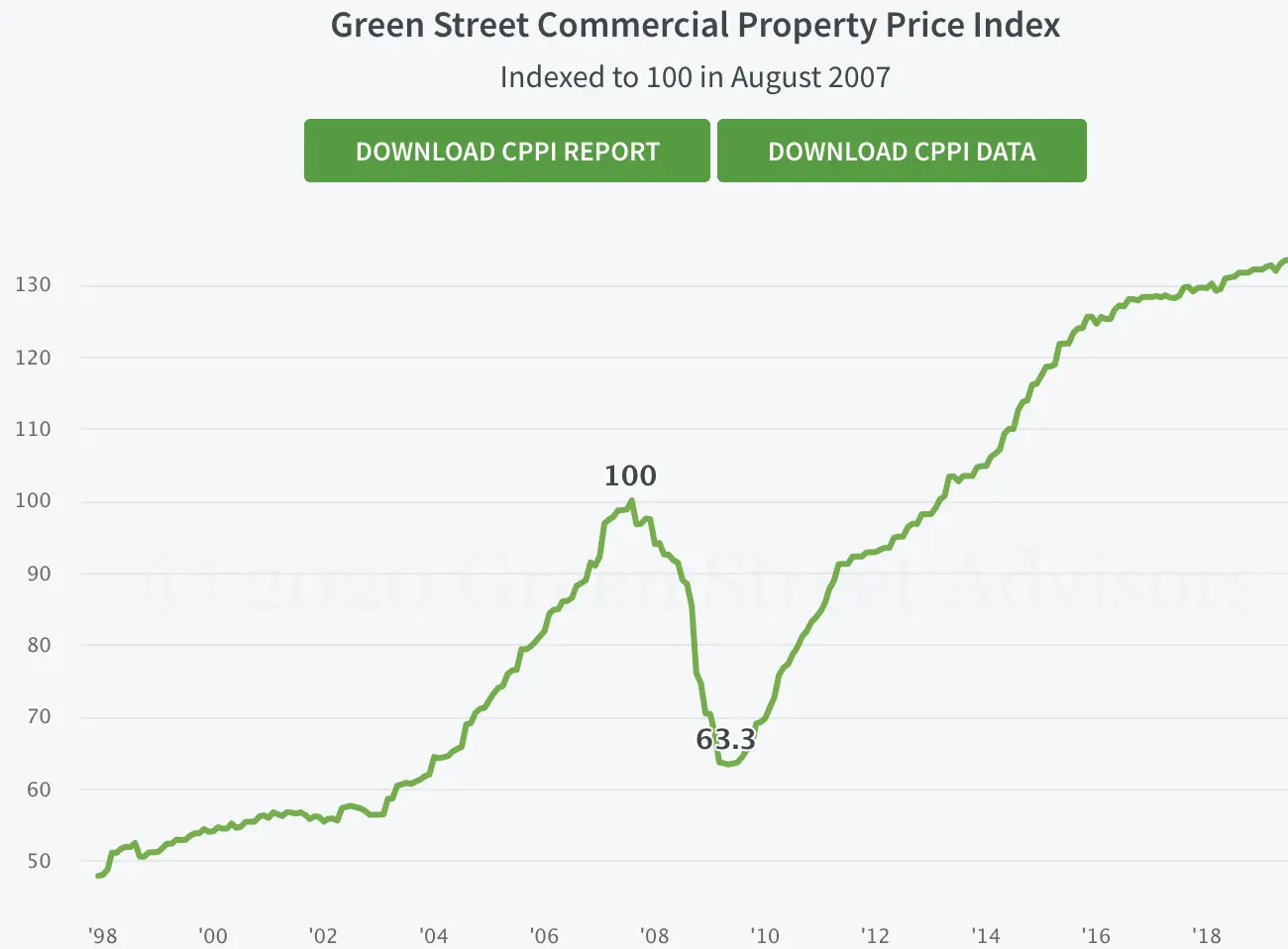

Landlords make as much from proprety values as from rent income

Youtuber and computer repair shop owner Louis Rossman recently complained about ridiculous asking commercial rents in NYC. This is similar to my experience.

Rossman says it’s because real estate is an easy way to launder dirty money – that’s not necessarily true. I mean, real estate is obviously a business with many crooked deals – one of the landlords I talked to was indicted for insider trading in the Pokerstars case.

But most urban landlords profit zoning regulations ensuring their proprety values grow at a healthy rate:

Renting at a lower price can hurt property value

This is counterintuitive and stupid, but commercial property value is based on what you could theoretically rent it for. If a landlord asks for a price and doesn’t find a tenant for a year, it may leave him with a higher property value than if he leased a tenant at a lower price.

When landlords are incentivized to protect your property value, this slows down the market price equilibrium process.

We really need a Land Value Tax

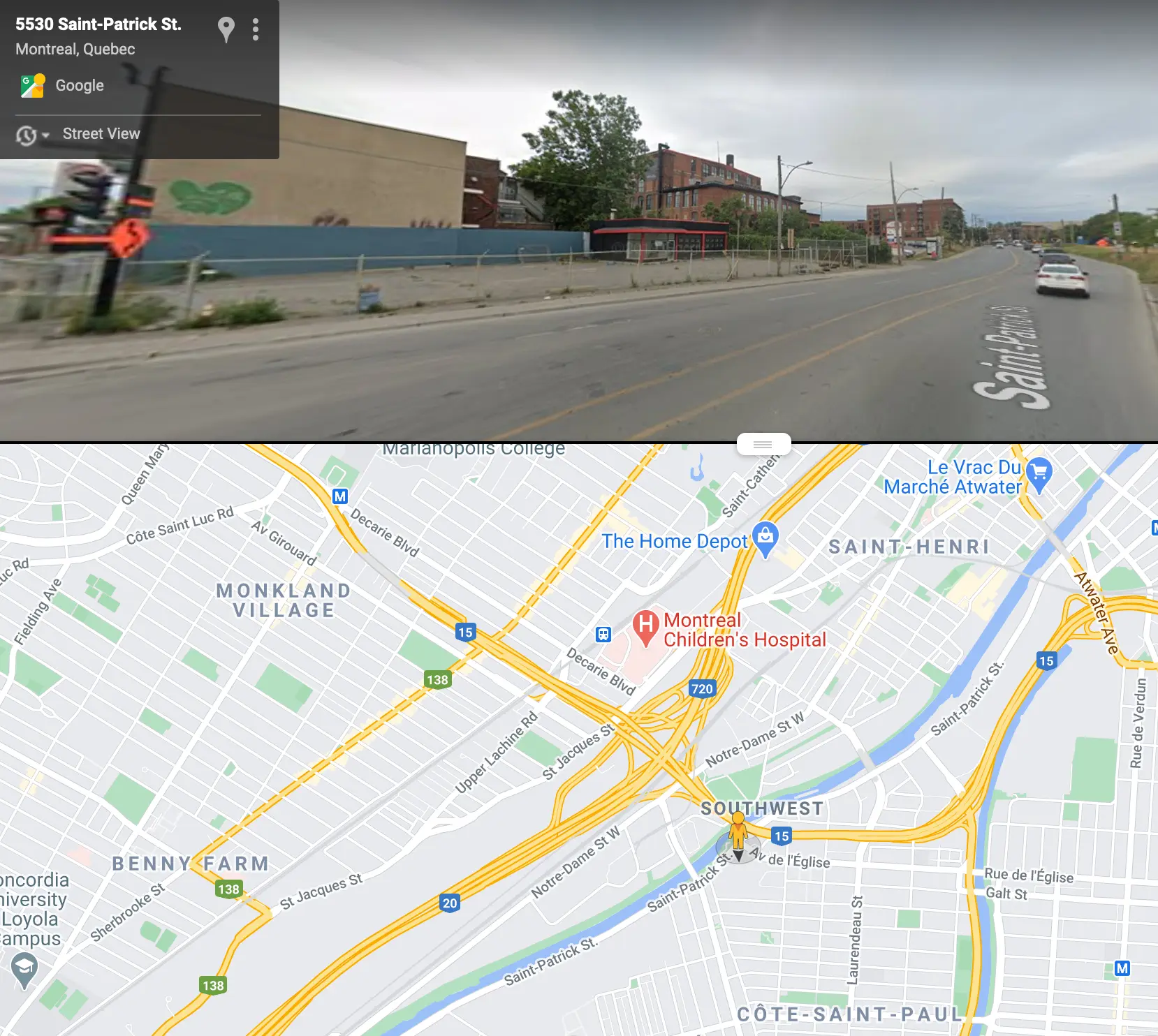

You can find examples of commercial properties in NYC sitting unused for years in Louis Rossman’s videos. Here’s one such story I came across when looking for a place to rent.

This is a closed garage whose ground was decontaminated in 2013 and hasn’t been rented since. The building is rotting in place, with severe water damage in the back and middle wall.

It’s a large, unexploited plot of land in a very premium location – close to downtown Montreal, next to the two main highways traversing the city. Notice the Brooklyn-style office lofts to the right in the back of the image, which are very much rented and economically dynamic.

The landlord is not incentivized to improve his land – he’s taxed on property value, so improving his property from this rotting shed increases the amount of tax he’d pay.

If he was taxed on the value of the land however he’d have been forced to do something with the property – either improve it and rent it, or sell it to someone willing to improve it.

This is a particularly egregious case, but our tax system incentivizes all sorts of behaviors reducing economic growth in dense cities.

Banks are really unsophisticated

Starting a physical business is capital intensive. This isn’t like a tech product which I can freely code up on nights and weekends – to open up a shop you’ll inevitably need to disburse some healthy 5 figure sum.

I make a very healthy salary as a data scientist but it’s but we’d still want a loan to ease up the cashflow when starting the business.

Banks are all over the place in what they look for in a business loan.

On one end of the scale, some banks work purely on verifiable networth. The fact that I make a six figure salary outside the business doesn’t even get considered.

On the other end, some banks consider “financial projections” which is really MBA jargon for “numbers you pulled out of your ass”. The projections will only come into effect after the loan is emitted so they can’t check the numbers without a time machine.

Even if the projections are completely wrong, well they’re uh projections. It’s not fraud because you can defend even the cookiest methodology for projections. Keep in mindthat the bank you do business with is paying some moron to do technical analysis for trades, which is as effective at predicting market movement as reading tea leaves.

My personal financial advisor worked at a major bank for a decade. She told me straight up: “Matt, you’re a smart, tech savvy guy. If you were evil you could catch me if you can the banks on loans so hard”.

Having gone through the wringer with a few banks, it’s true. It’s really easy to modify a few pdf files, and banks have a hard time verifying beyond that. They give out loans to all sorts of people who shouldn’t get a loan because they’re basing their decisions on rules of thumb.

All the credit score tricks are true because credit checks are stuck on a simple model

For a new business, a bank can effectively only really evaluate you through credit checks like Equifax. Equifax’s isn’t a tech company – just go to their website and bask in all the cheapest-contractor-available glory of their web app. They got hacked, and their site is still horrible, they’ll get hacked again soon enough.

Equifax entirely missed my student loan for instance. Which should be a decent predictor of my credit.

Equifax predicts you credit score on effectively 2-3 variables – use of available credit, late payments, recent credit checks. Because the system is effectively a 3 parameter logistic regression, it’s dumb and only reacts to these parameters. While Equifax does try to get as much data on you as they can, simple features like credit utilization end up mattering most [footnote]Until they start scraping your instagram stories, that is[/footnote] So when you hear tips like:

Get as much personal credit as you can, then use it to 3-4%

Pay your phone bills on time

They’re generally true. It’s the most important information Equifax consumes and all the loan decisions in you financial system go through this model. I encourage you to check your credit score – it’s a $20 well spent to see how this sausage is made.