The State of Stablecoin Risks (June 2022)

I cover risks inherent in USD Coin and tether USD.

Thanks: I want to thank James from DirtyBubbleMedia for help with this piece

Disclaimer: At time of writing, I hold short positions against $SI and $MSTR, whose stock prices are related to material discussed herein.

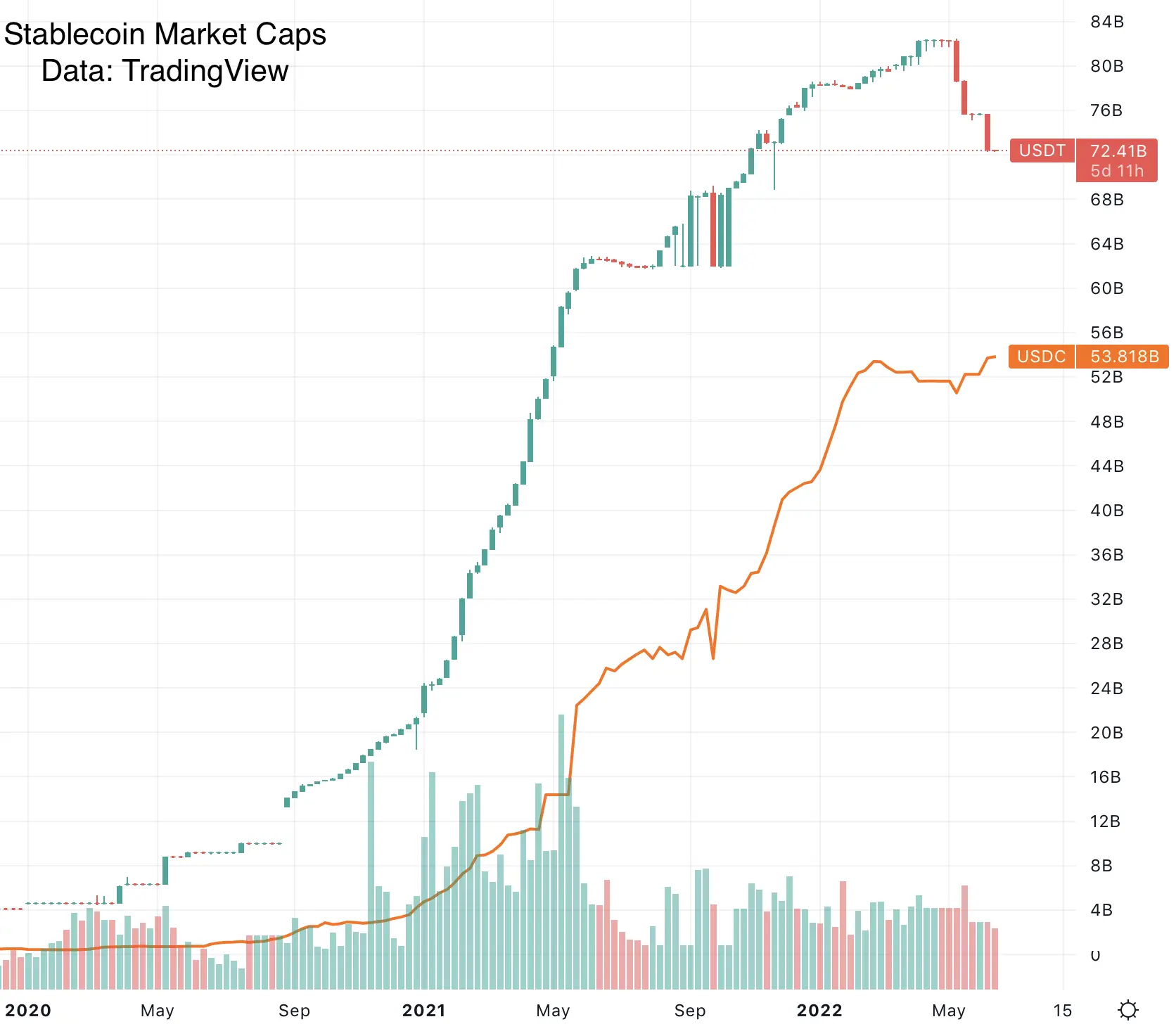

It’s over a year since I last wrote about tether. Since then, stablecoins have become a $150B market and a point of concern for financial regulators.

At time of writing, the price of Bitcoin is roughly $22k, and the total market capitalization of the cryptocurrency ecosystem is roughly $950B. USD-backed stablecoins are currently 16% of the total crypto market cap.

Cryptocurrency market caps are a nonsensical number supported by shared fiction. Stablecoins market capitalizations, however, aren’t. One dollar is one dollar whatever happens to the crypto speculative mania cycle.

Last time the total market cap of crypto was $1T was in December 2020. Stablecoins were around 2% of the market. The cryptocurrency markets are now in a precarious situation in comparison to 2020 - 16% of the market is still sitting around as leverage waiting to be unwound.

So today, we’ll talk about USD-backed stablecoin risks, specifically USD Coin (USDC) and Tether USD (USDT)[footnote]Binance USD (BUSD) is similar to USDC, but I haven’t researched it, so it won’t be discussed[/footnote].

I don’t care much about risks in algorithmic stablecoins. As Luna/UST[footnote]RIP[/footnote] and Iron Finance[footnote]RIP[/footnote] have shown us, they’re inherently unstable and should rightfully be marked to $0 in a portfolio. On the other hand, overcollateralized stablecoins like DAI only serve to increase systemic leverage in the cryptocurrency economy[footnote]The primary usecase is to lock up BTC to generate DAI, to buy BTC, or some roughly equivalent scheme[/footnote], but aren’t by themselves a clear point of danger.

USDC

USD Coin is the adult of the two major stablecoins. It offers programmable APIs to deposit money for USDC and to redeem USDC for money. This is frictionless compared to tether, whose redemption mechanisms are described as “messy” by Sam Bankman-Fried[footnote]No doubt due to tether’s issues maintaining banking relationships[/footnote].

Because of USDC’s ease of use and lack of being obviously fraudulent, USDC has grown tremendously since early 2021:

Note how in May 2022, in the collapse of the LUNA stablecoin, around $10B of USDT redemptions came in. Of this, around $5B was “USDT de-risking” where market makers swapped USDT for USDC.

USDC has the money

Despite being evasive about details of their reserve makeup, USDC “has the money”. At least in the layman understanding of the term: there are banks which agree they owe that much US dollars to Circle[footnote] Circle is the company running USD Coin[/footnote].

How we know

First, as noted in a previous post, USDC had an audit in December 2020, which confirmed they had $4B for the $4B USD Coins out there. Since then, USDC grew by $50B. But we can track the money.

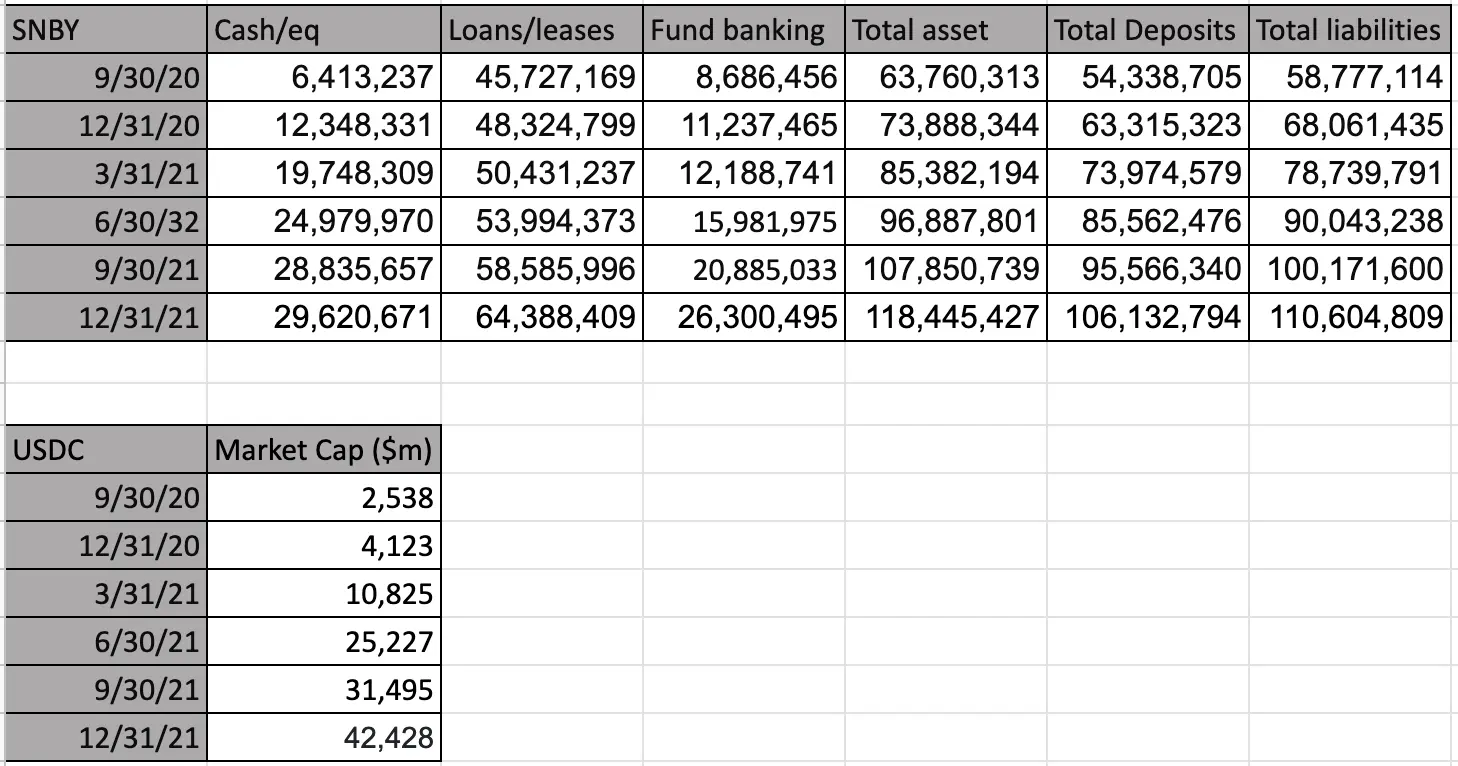

USDC largely banks at two places: Silvergate Bank (SI) and Signature Bank of NY (SBNY). These are the only two US banks which offer 24/7 API based transactions to cryptocurrency companies, a requirement to run something like USDC. In a sense, USDC is a middleman between Signature and Silvergate banking services on one side and on-blockchain trading on the other.

Because SI and SBNY are public companies, we can track their balance sheets every quarter in their respective SEC filings (SI, SBNY). $50B is a lot of money, even for a bank, so we can track the balance sheet changes created by USDC growth. Correlating USDC to the balance sheets, we see that USDC has largely banked at SBNY during their 2021 growth:

Note: Thanks to Mike from DirtyBubbleMedia for help putting this analysis together.

This correlation is also confirmed by SBNY Earnings calls. Reading Q2-Q4 2021 it is clear that cryptocurrency offerings are behind most of the bank’s balance sheet growth [footnote]USDC, but also banking exchanges and other “institutions” - presumably trading firms like Alameda Trading and Cumberland Global[/footnote]

Bank run risk

When we’re talking about $50B, saying something like “I have the money” has nuance. Who holds that money for you? How quickly can you get it if you wanted to transfer it?

The main problem with USDC is that USDC largely banks with SBNY, and a large fraction of SBNY’s liabilities are specifically to USDC.

Notice in the balance sheet above that SBNY acts as a normal bank would: they lend out a lot of this money!

In normal times, this wouldn’t be a problem: individual depositors at a bank are insured by FDIC to prevent bank runs. But in USDC’s setup, there’s only one individual depositor (USDC) and all of their depositors have a claim against USDC, not the bank SBNY. This is a problem - if there’s a bank run on USDC, USDC promises instant redemptions. But these redemptions immediately become a bank run on SBNY, who have most of that money lent out!

Individual USDC holders probably won’t qualify for FDIC “passthrough insurance” in the case of a USDC->SBNY bank run contagion. So USDC, while doing most things roughly correctly, are still subject to significant bank run risks compared to a traditional bank.

Remember, USDC is the good one. Bank run risks are nothing compared to whatever tether has in store for us.

USDT

USDT has been described as “quilted out of red flags”. For example, just the other week, they’ve refused to disclose holdings in US Treasuries, the most boring asset in all of finance. According to tether, doing so would “reveal their secret sauce”. Doing so would also would have instantly resolved all questions on tether’s solvency issues. This behavior is why everyone is suspicious of tether.

The Tether Bezzle

Despite the Ponzi Hypothesis I advanced last year, USDT is only partly a Ponzi scheme.

However, tether is most certainly insolvent! It has a bezzle between their assets and liabilities. A Ponzi scheme is a specific type of fraud and tether is a few different kinds of fraud which evades easy categorization.

Stop caring about what tether declares their reserves to be

A common trap investigative journalists fall into is providing any credence whatsoever to tether’s self declared reserve makeup. For instance, Patrick McKenzie analyzed tether’s reserves and found they’d be insolvent in May 2022, because their cryptocurrency holdings would have lost more than the $160m in excess assets they held.

The problem here is that the $160m in excess assets is complete fiction. Tether has declared excess assets to be exactly $162m for two years now, as the size of their reserves grew from $10B to $84B. You can verify this for yourself by going in the web archive of tether’s automatic transparency page.

Similarly, tether’s attestations are a red herring. The auditing firm has, as far as I and other journalists have been able to tell, a single relevant professional accountant.

This David J. Walker is apparently the only CPA on planet earth willing to sign attestations for tether. It’s well documented that no firm ever audited tether, despite the apparent simplicity of their balance sheet.

So when tether declares they have tens of billions in commercial paper no one has ever found or heard of, trying to find what they are is chasing the red herring.

Tether’s numbers are simply made up, or we should at least treat them as such.

Insolvency

To find the truth about tether, you need to go about the other way and see where USDT go to and come from. The best piece of journalism on the matter remains Protos’ Tether Papers, which breaks down where all newly minted USDT went.

Digging into it, it’s overwhelmingly likely that tether is insolvent. Here are a few avenues of loss:

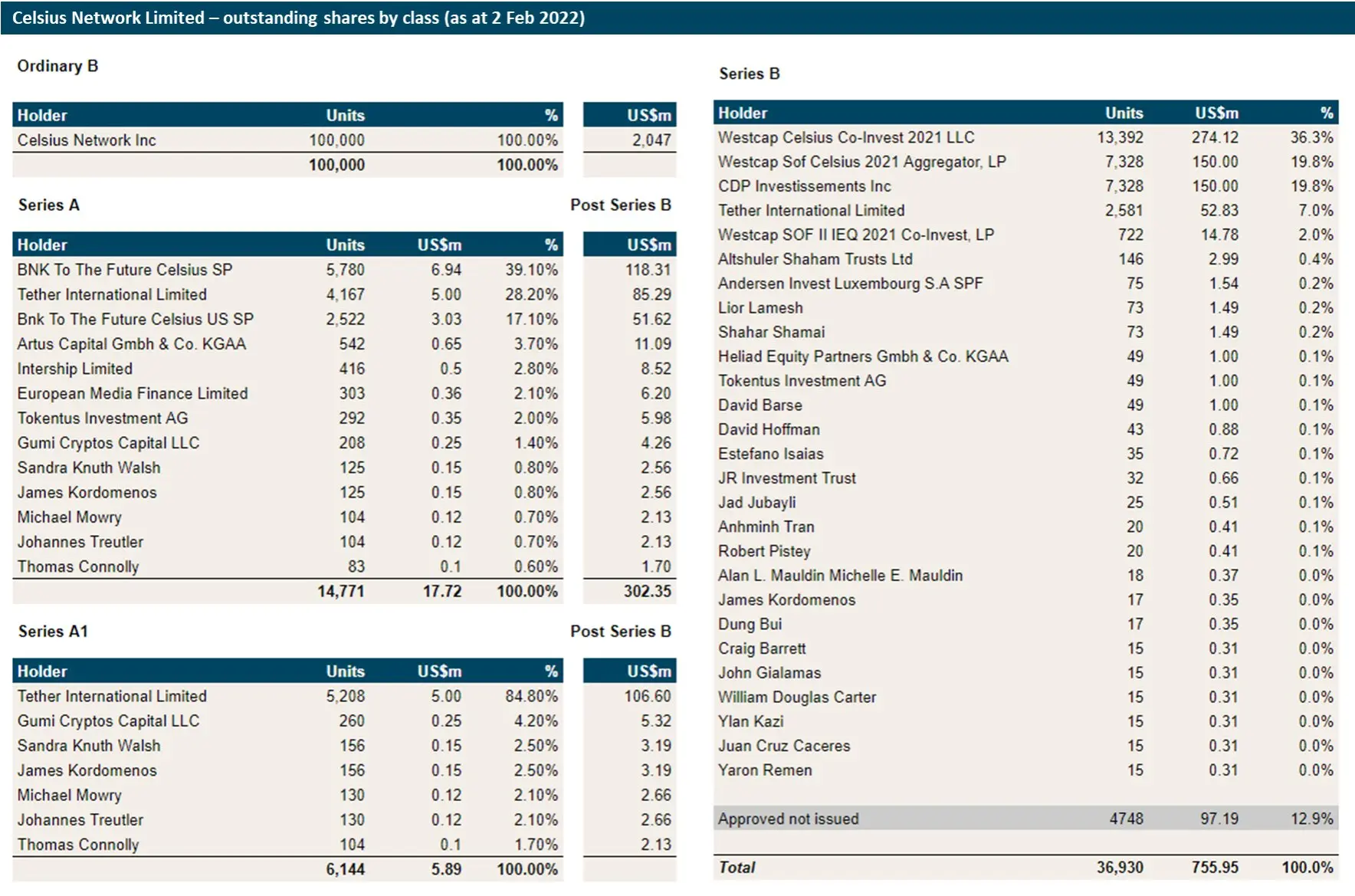

- It’s well known that tether minted $1B in exchange for a bitcoin collateralized loan from Celsius.

Note that this is specifically the “tether ponzi scheme” thesis in play. BTC collateralizes new USDT, which is used to buy new BTC, rise, wash, repeat. But also note from the tether papers that the tether Ponzi is likely only playing out in the “Funds and other companies” section of issued USDT, so the tether Ponzi thesis is at best partly true.

Of course, tether also invested around $190m in Celsius equity (source @intel_jackal):

Celsius is currently under, uh, financial difficulties, so I wouldn’t value the equity at cost basis or the loan at par. And given the loan was collateralized by BTC when the price of BTC was double what it is now, tether is underwater on this deal in any case.

You don’t have to believe me, though, because you should never believe something until tether explicitly denies it

As Patrick McKenzie noted, tether themselves declared holding cryptocurrencies in reserve. These have dropped in value by more than their declared excess assets. Take tether’s words for what they’re worth - this is what tether thinks is the best light they can present themselves under, and even then they’re insolvent.

It’s difficult to believe tether holds their reserves in US dollars. The only bank with USD access to admit doing business with them, Deltec Bank from the Bahamas, which doesn’t nearly hold enough assets (overseas or locally) to explain tether’s asset grown in 2020 to 2022. Tether’s numbers don’t match up to the Bahamian central banks statistical reports for Deltec to be tether’s primary bank.

If tether holds their reserves denominated in other currencies than the USD, presumably CNY, they took foreign exchange loss against their USD denominated liabilities in the 2020-2022 period and are insolvent from that.

Frankly, it’s not hard to draw up plausible scenarios where tether’s liabilities exceed their assets.

Insolvent doesn’t mean bankrupt

Being insolvent doesn’t matter much, as long as you can keep paying creditors. Say, in a hypothetical, that tether lost $1B in reserves because they had to bail out their sister cryptocurrency exchange who got stiffed by money launderers. This wouldn’t matter until that money is actually needed to pay someone, which could be years away.

For instance, QuadrigaCX had about 9 times more liabilities than assets for over a year before collapsing. By the time Madoff’s Ponzi collapsed, he had $17B in assets against $65B in liabilities, a state of affairs he maintained for over a decade.

Point being that insolvency only matters when the bankruptcy process starts. This happens when a tether creditor is refused a USDT redemption. Until then the music will keep playing. The question is how deep the tether insolvency goes and when do redemptions start being a problem.

Tether (probably) has a lot of real money

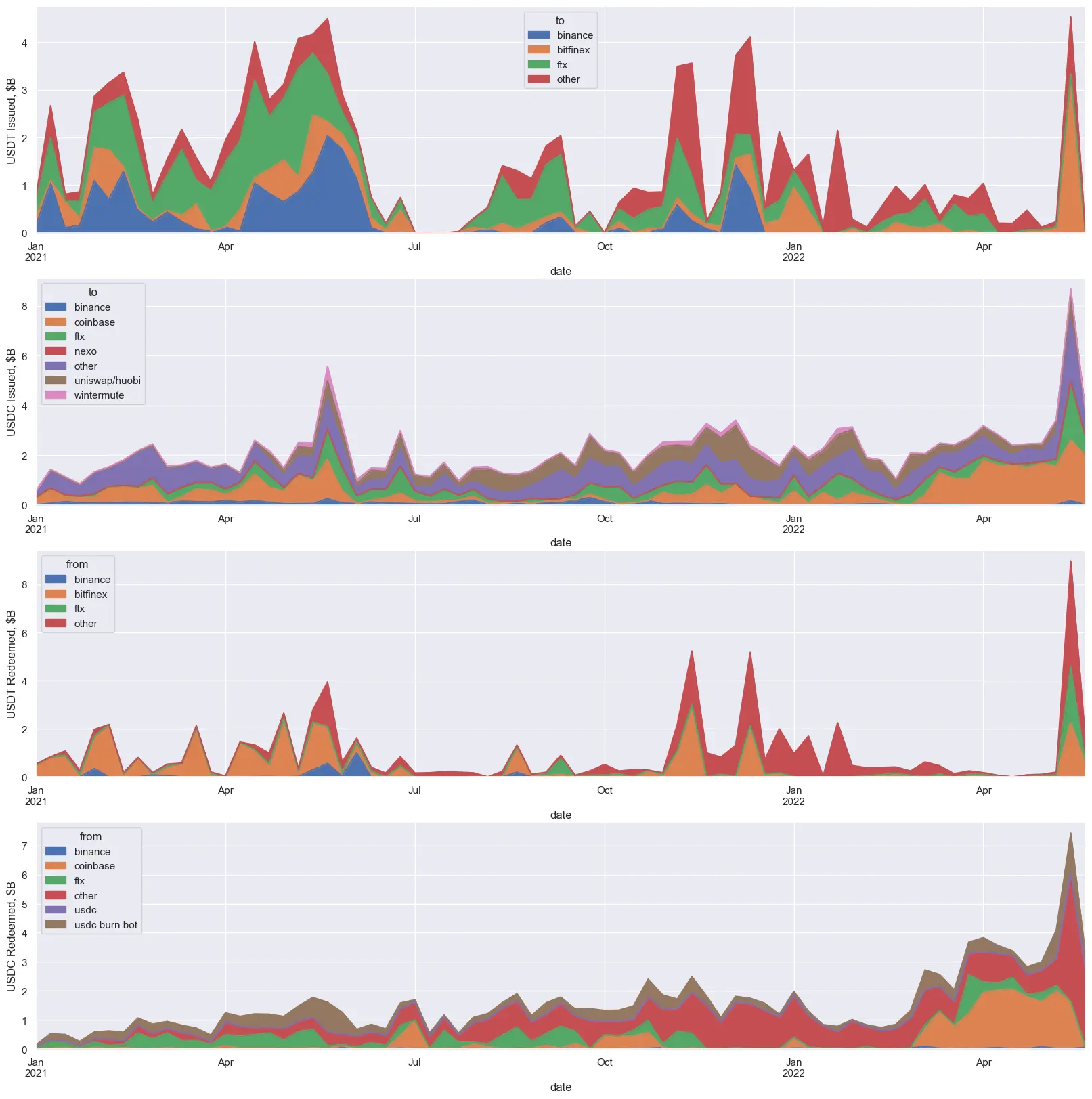

We know that USDC has the money. We also know that almost half of USDT was minted by two algorithmic trading firms, Alameda Research and Cumberland Global. Alameda specifically also minted a lot of USDC, as we can see here:

Since Alameda and Cumberland are apparently capable of paying for new USDC, we have to assume possible that tether has had a lot of real money pass through them from USDT Alameda and Cumberland.

Tether might still have shady loan deals with these trading firms, or mismanage the money they receive, but it’s very possible that tether had tens of billions in real money at some point.

Tether seems to service redemptions through bitfinex customer funds

The people running tether and bitfinex are clearly comfortable treating all assets they control as a single slush fund. They’ve used tether funds to paper over bitfinex losses in the past.

It wouldn’t be a surprise then to learn that tether uses bitfinex funds to service redemptions. Note above that bitfinex is a large part of USDT redemptions. This is because a lot of USDT redemptions are serviced with bitfinex as the last point of contact - Alameda admitted to it themselves.

Recently, many addresses like this one redeem hundreds of millions in USDT to bitfinex. Every couple of days bitfinex may send it back to the tether treasury to remove them from the market.

As far as we can tell then, tether redemptions are served as bitfinex withdrawals: bitfinex customer funds are possibly used to service USDT redemptions, or redeemers get a “store credit” in exchange for their USDT.

In a sense, this helps tether’s business. They have a deeper pool of liquidity to pay out redemptions if they treat all the money from tether and bitfinex as a slush fund.

If you’re keeping a close watch on tether redemptions, you should look at the Bitfinex Tron and ETH wallets[footnote]For some reason, Bitfinex 2 is the more important redemption wallet on ETH[/footnote] as well as the tether treasury addresses (Tron, ETH).

At the time of writing there’s $500m USDT tokens that are seemingly “redeemed” in bitfinex wallets but not sent back to treasury. If you want to monitor stablecoin risks, keeping an eye on this phenomenon would be a good leading indicator of tether issues coming up.

Unwinding stablecoins

As the total market cap of crypto goes down, stablecoin market cap will have to be reduced. Stablecoins were largely used for two reasons in the 2020-2022 crypto bubble:

Market liquidity. USDT is the denominator for the majority crypto trading, as we saw in my article on manipulation. As market sizes and trading volumes go down, the demand for a large stablecoin liquidity pool is reduced, thus requiring fewer stablecoins

Systemic leverage. This is the basic scheme we see in DeFi, crypto P̶o̶n̶z̶i̶ ̶s̶c̶h̶e̶m̶e̶s̶ “lending schemes” like Celsius, BlockFi and other Yield Farming products.

The gist is that you mint a stablecoin to lend it out to someone seeking margin to trade on. Because the entire cryptocurrency ecosystem is effectively just a casino of interconnected poker tables, the only thing to be done with the margin loan is “trade with it”.

Often, this is compounded. If Celsius is paying out 18% on USDT lent out, but Aave charges 8% for borrowing, why wouldn’t you leverage up on this trade? Traders think they’re making a cunning arbitrage play when in fact they’re moving stablecoins from a pile of DeFi dynamite into the bonfire of a Ponzi scheme.

This is why the best indicator to look at when seeking frauds is a ridiculous Risk-Reward (Sharpe) Ratio. If you invest in a market index, you might get a 5% return. But this comes with volatility that prevents you from using too much leverage. Once in a while, the index will lose 50-70% of its value, in a recession. If you are levered more than 2-3x, you will get wiped out.

A fund like Madoff’s Ponzi not only promised 15% returns, but promised it risklessly. The return chart of the Madoff Ponzi was a straight line, 45 degrees up and to the right. This means you could take on 10x or 40x leverage and get a 150% or 600% return.

Sure, you’ll get wiped out when the Ponzi collapses, but that’s also true if you used no leverage.

As crypto prices go down, the effective demand for both uses of stablecoins are reduced.

How does this end?

In short, the music stops when tether can’t service a redemption. We may have to see $20B in redemptions before this happens, or $50B.

I used to think that USDC would largely be redeemed before tether saw a redemption run, because USDC is much easier and safer to redeem. If you need to unwind stablecoins, why do it in a messy way that pokes the tether apocalypse dragon?

Instead, it seems that DeFi lending protocols have put pressure on the USDT peg in May 2022, around the collapse of the LUNA-UST stablecoin system.