How badly is cryptocurrency worsening the chip shortage?

Here’s a rough estimate on much wasted semiconductor production there is because of proof-of-work

TLDR: In 2021, very roughly:

- 1/5th of all new GPUs in 2021 went to ethereum mining.

- 4% of TSMC’s production top tier capacity (7nm and 5nm) went to bitcoin mining.

- 0.5% of global energy use went to crypto mining (95% from bitcoin)

Note: Ethereum has since moved on from Proof of Work. Good for them!

I wouldn’t care so much about cryptocurrencies if it weren’t for proof-of-work (PoW). Let’s estimate how much the 2021 chip shortage is affected by cryptocurrencies, then talk about how PoW has to be replaced by some other mechanism.

We can estimate a cryptocurrency’s resource use from the network hashrate, a public figure, and what type of hardware is being used up on PoW mining.

Demand for PoW mining is one-to-one with the market price of Bitcoin and Ethereum [footnote]See final section below[/footnote]. We’ll be tracking the one year period starting March 2020.

TSMC production on Bitcoin Mining

Bitcoin is largely mined with application specific integrated circuits manufactured by Bitmain.

Hashrate and capacity use

BTC Hashrate increased by roughly 50ExaHash/second in the time period.

An Antminer s19 mines roughly at 100TeraHash/s. So about 500,000 antminer units were added.

But it’s unlikely each Antminer s19 takes up a full wafer. A better guess is around roughly one sixth of a TSMC 7nm wafer. We can ballpark this from Bitmain’s unit profit margins (45%) and s19 market prices ($3000), and the cost for a 7nm wafer ($9,000).

We can crosscheck that against the s17 model, which included 144 chips at 7nm. Previous antminer chips have been around 20mm^2 which would take a close to a full wafer per antminer unit given a 300mm wafer. But the actual silicon die on those 20mm chips is likely smaller than 20mm - there is probably a few antminers produced per TSMC wafer in general.

TSMC produces 150k 5nm wafers per month. They produce similar numbers for their 7nm wafers.

Conclusion: Bitcoin mining takes up something around 4-6% of TSMC’s leading node production capacity

This is in line with 2018 estimates which put Bitmain at 4-5% of TSMC capacity use.

Along with AMD, Apple, Intel, MediaTek, Nvidia and Qualcomm, Bitmain is one of the few elite companies that has access to TSMC’s 5nm process. All the other companies use the chips to make the very best CPUs, GPUs and smartphone chips. Bitmain’s chips, on the other hand, transform electricity into money. Obviously Bitmain are willing to pay top dollar for TSMC production capacity.

TSMC 5nm are the very best silicon chips humanity is capable of producing, in limited quantities. Every gram of silicon going to Bitmain is silicon not going into an iPhone or laptop - thus driving up prices for everyone else.

Don’t believe any argument defending Bitmain chip production on the basis that this would “incentivize supply”. Arguments of the form “current waste will incentivize us to be more efficient in the future!” don’t make sense in general. Second order effects don’t dominate first order effects.

These arguments make even less sense for semiconductor use. We are in a shortage. The market has constrained supply. An artificial increase in demand can only drive up market price.

GPU production wasted on Ethereum Mining

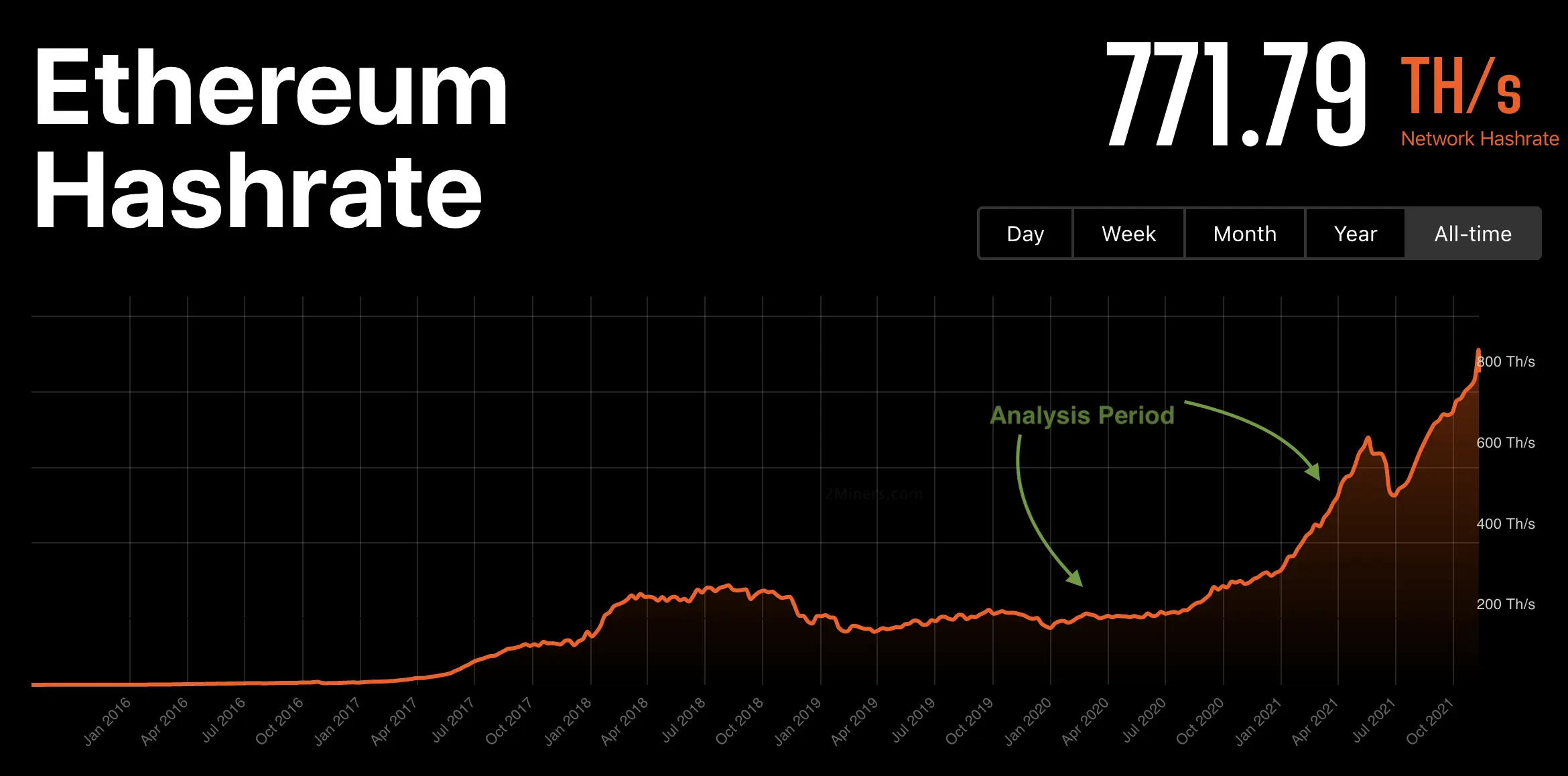

For ETH, network hashrate increased from 150 to 600 TeraHash/s

A RTX 3070, which we’ll generously take as the “average GPU sold” produces 60MegaHash/s.

This translates to roughly 7.5M additional RTX 3070s mining. There were 41m new GPUs sold in 2020

Conclusion: roughly 19% of GPUs produced in 2020 went to the ETH mines

It’s important to note The ethereum mining problem is getting worse. It increased further from 600THash to 770THash in the period after analysis.

An equivalent of 2.5M RTX 3070s have been gone to Ethereum mining since the end of the analysis period. These are all units that don’t go to productive uses like deep learning, video production and of course gaming.

It’s hard to know how much this wasted production is translated into increased prices for consumers[footnote]we’d have to estimate price elasticities, which are a harder task[/footnote]. But it’s definitely increasing market-clearing equilibrium price. This is why GPUs are being scalped since 2020 - the MSRP is below the market price given crypto miner demand.

The energy consumption is also awful

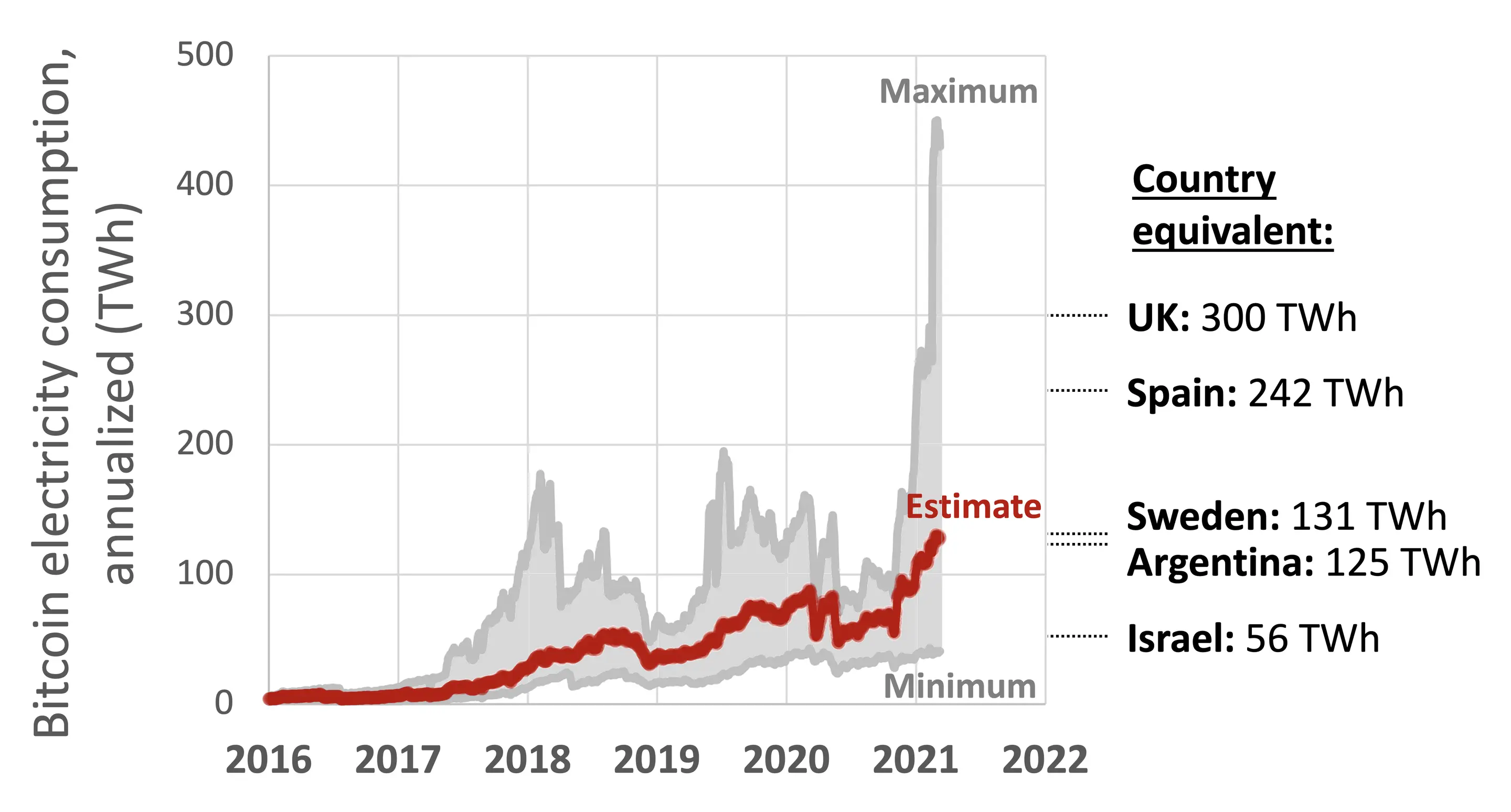

Oh yeah, the energy use. For bitcoin it’s anywhere from a Denmark to a Sweden in energy use. A lot of that is coal.

Free markets mean the energy costs will be minimized by finding the place where electricity is cheapest: this can be places where electricity is subsidized (hence stealing from taxpayers). Or where externalities aren’t priced in. Kazakhstan is currently a hot place for mining because carbon emissions aren’t taxed - half of Kazakh energy is from coal. Previously it was in northern China, before the government made it very illegal to mine cryptocurrencies.

Ethereum’s energy use

People often talk about Bitcoin’s energy use, which is appalling, but Ethereum is no slouch either.

We can conservatively ballpark Ethereum to use about as much electricity as Senegal. This is purely in addition to Bitcoin’s energy use.

The network hash rate is 770THash/s. Our baseline hash rate is a RTX 3070 at 60MHash/s, which means the network runs about 13M GPUs. At 300watt per unit this means 3.9TeraWatt/hour.

You can take your pick here to see where 3.9TW/h fits, it’s near Senegal or Laos.

Between Bitcoin and Ethereum’s energy use, we’re around 0.4-0.5% of humanity’s total energy output.

Proof of Waste

It’s hard to oversell just how wasted all of these resources are.

The way you should think of proof of work mining is that all of these resources are used to guess random numbers as fast as possible. Every ~10 minutes, the computer that guessed the correct number gets the free coins. It’s that stupid. When you see a number like “60MegaHash/second” this just means your GPU can guess 60,000,000 times a second.

If more computers connect to the Bitcoin network to guess random numbers, it adds to the “network hash rate”, so the number becomes harder to guess automatically.

Adding more GPUs to mine ethereum doesn’t make the blockchain process any more transactions. It just makes each individual transaction more expensive.

The network is secured with money, not CPU cycles

The math and algorithms used to to design the specific guessing problem don’t matter. Proof-of-Work is an economic incentive. Cryptocurrencies core tradeoff is that they eschew the concept of trust in humans. Blockchains create an economic incentive (free coins!) for people to validate the transaction.

The only thing that matters is the amount of money if costs to mine, versus the value of what you get in return. The blockchain’s validity is secured by how money expensive it is to forcefully invalidate a transaction.

The reward for mining is a coin which you can sell at the coin’s current market price. The difference between the cost to mine a coin and the reward will tend to zero over time.

This arbitrage process will run through all hurdles until there’s a financial bottleneck, where it will finally concentrate. For most proof-of-work protocols, the bottlenecks are either energy costs or hardware supply.

The energy use and silicon use are a wasteful byproduct of the monetary incentive scheme to secure the network.

There are also side-casualties from this, like any service offering free computing time being exploited to mine crypto.

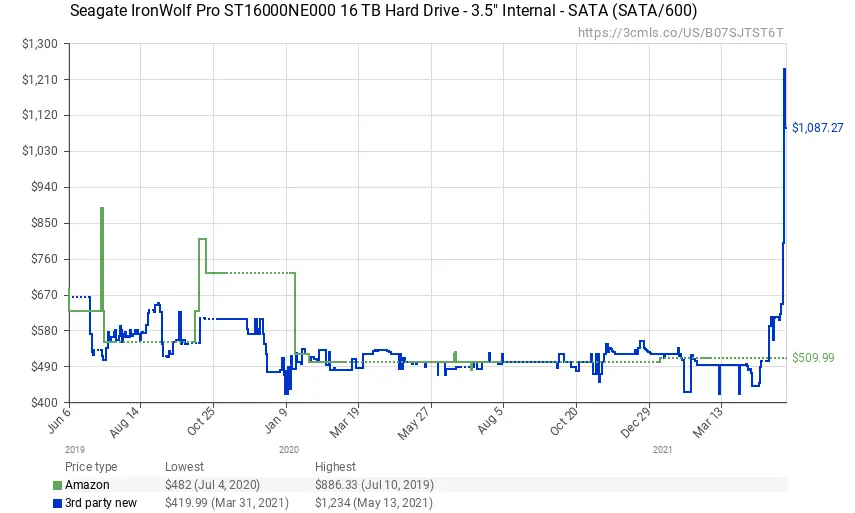

Naive answer: Chia being “green”

One crypto enthusiast saw that people were angry with Bitcoin’s energy use and thought: “what if people held their random guesses as bingo cards on hard drives instead of repeatedly guessing? Surely THAT would save the planet!” [footnote]That’s the charitable take. The realist take is “what if I sold this green crypto pitch to stupid retail investors, and dumped pre-mined shitcoins into their FOMO-driven buying frenzy to get rich?” An idea which was a tremendous success.[/footnote]He decided that would make a “green” cryptocurrency, even branding the logo with with a cute leaf:

You don’t have to think for very long to see the issue with this scheme. If no money is used to pay electricity bill, the zero-financial-arbitrage condition must still hold. So all the mining money will instead go to buying up hard drives:

Is the planet destroyed faster by wasting $100 in electricity or $100 in hard drives? The answer depends where you get your electricity. But no one should be thrilled at the great ecological success of taking thousands of tons of hard drives and putting them into a garbage bin.

The only way to reduce the consumption is to reduce the market price

People destroy the planet mining proof-of-work as long as they can get valuable cryptocurrencies in exchange. Cryptocurrencies are designed to evade government intervention (and hence law enforcement) by design.

The only way to seriously reduce the waste from proof-of-work is to reduce the market price of Bitcoin and Ethereum.

Stupidity and lies to the defense of the energy use

Because the only way to reduce energy use is to reduce the market price, a lot of people who want the price to be high will try to find ways to defend the resource waste.

Gaze into the abyss:

This is a particularly smooth brained take from someone managing a crypto fund.

First, you’re not turning electricity (or hard drives) into money by mining cryptocurrencies with it. You’re turning one quantity of money into a different (hopefully higher) quantity of money. Mining does this by wasting the input money on electricity, silicon or whatever else grifters will come up with. The output money comes from selling the mined tokens on the market.

Second, it’s not like that electricy is stored in any case. Further electricity has to be burned to validate the transaction selling the tokens. Crypto tokens are not even storing financial value - “storing” implies getting back what you put in, but cryptocurrency price volatility is really high. A “store of value” is about low price volatility, not expected appreciation. You can only say you’re “storing” financial value if you make up a new definition for the word “store”.

Third, never mind. I’m not even sure what kind of schizophrenic process leads the “battery” neuron to connect to the “bitcoin” neuron, but it’s not one based in rational thinking. Only someone whose financial well-being depends on the market price of Bitcoin or Ethereum will seriously believe this, and they’re not reading this far into the article anyway.

If you want your crypto casino, please make it proof of stake

People make a lot of wind about what various blockchain applications could do or will do. A decade after blockchain came into popularity, the only popular usecases are financial speculation and capital control evasion.

Crypto enthusiasts often compare the internet, but a decade into the internet’s explosion into popular we had plenty of actual uses between buying stuff (Amazon, Ebay) retrieving information (Google, Yahoo), messaging people (email, instant messaging), transmiting information, etc.

People don’t legally use cryptocurrencies for anything else than to “invest into it”. Also known as gambling. And if you just want to gamble that’s fine by me! Just don’t destroy the planet doing it.

It’s secured by money. Just secure it by money.

Since the blockchain network validity is secured by money anyway, you might as well abandon the pretenses and just secure it with money.

This is called the proof-of-stake mechanism, where staked money literally validates transactions. Rather than implicitly securing by money through resource waste, you secure it by using money.

Stop wasting resources. Secure it with money.

Layer 2 solutions do not and will not work to solve this

One last argument from (even respectable!) people is that we can minimize the energy use through layer 2 solutions.

No.

As long as the market price is high, the resource waste will match it.

This equality holds regardless of the number of transactions on the network or on whatever additional misguided scaling layer you slap on top of it. As long as you can sell a Bitcoin for $65,000 the network will continue wasting 100TW/h. This is regardless of it processes one transaction per minute or one hundred thousand.