Bad Economics: Is Obama Designing the End of Capitalism? (Ben Shapiro, 2009)

Part of a series debunking incorrect economics on the internet

Reading time: ~4 minutes.

In this post, we look at an economic commentary from political pundit Ben Shapiro. Credit to besttrousers for lots of the info in here.

Shapiro’s thesis here is that Obama wants to end Capitalism itself by inflation of the US currency, by spending a bunch of government money.

All of Obama’s economic policies thus far are designed to drive America into full embrace of socialism. His chief means for this transformation: inflation.

Let’s sidestep the inflation -> Socialism thing for now and concentrate on this:

He is attempting to inflate the currency through two primary means: intense deficit spending, and pushing up production costs through union subsidization.

Had Shapiro took his introductory macroeconomics, he would know Inflation is always and everywhere a monetary phenomenon (perhaps with some caveats). In layman terms, inflation is linked to the money supply, not to government spending.

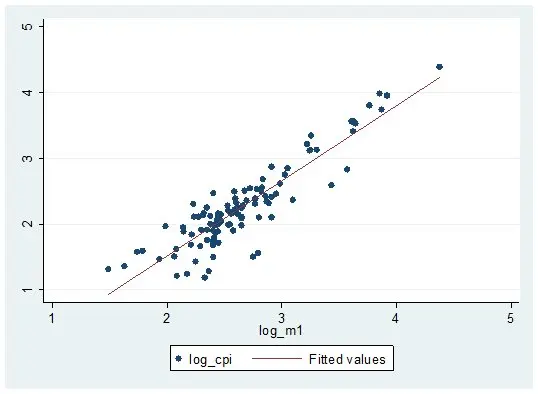

It’s easy to convince yourself of this: look at this graph:

The X axis is the M1 measure of money supply, and the Y axis is the consumer price index (common measure of inflation). This relation comes with an impressive Rsquared of 0.91.

So we could say Shapiro is at best 9% right here. As they say, “Facts don’t care about your feelings”

Obama pursues inflation – government devaluation of the currency – with the zeal of the newly converted. His deficit spending will be financed either through higher taxes or through inflation.

US inflation, 1965-2015. Note Obama’s great hyperinflation starting in 2009 that transitioned the US to Full Socialism™. I’ll also leave the chart of US tax rate, 1920-2010 for good measure.

According to economist Murray Rothbard, within a week after the stock market crash of 1929, the Federal Reserve pumped cash into the system […] This, of course, did not stave off the Great Depression

First, citing Murray Rothbard on topics of monetary policy is akin to citing the one last remaining biologist who thinks Lysenko got it right over Darwin. He’s so far off from the professional consensus as to be the living “exception that confirms the rule”.

Instead, a better read on the great depression is from Ben Bernanke, who incidentally is one of the few human being in history to have prevented one. Another good account is by Scott Sumner.

For the impatient, we can cite this review of Eichengreen:

The gold standard (a fixed exchange rate system) was crucial in the onset of the downturn because it transmitted shocks between countries and because monetary authorities were unwilling to follow expansionary policies fearing that the consequent gold outflows would threaten convertibility.

Basically, the monetary policy response under a 1928 gold standard to the Great Depression was a cause of the depth of this depression. It certainly can’t be compared to the monetary policy tools we have with a fiat currency to prevent the propagation and deepening of the shocks.

Back to Shapiro:

When it comes to inflation, very few people can identify its pernicious effects; it’s far easier to cite the dangers of laissez-faire capitalism. Which, of course, is Obama’s plan.

Of course it’s very hard to identify the subtle and underhanded pernicious effects, like in Zimbabwe in the 1990s, or the Weimar Republic.

All in all, one should check his facts with at the very least basic data before making up grand theories.